Author Archive

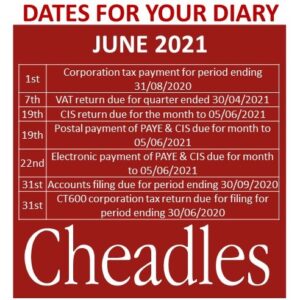

Dates for your Diary June 2021

Wednesday, May 26th, 2021

Why Cloud Accounting?

Wednesday, May 12th, 2021Why Cloud Accounting?

9 Reasons Why Cloud Accounting is the FUTURE of accounting!

- Automatic Bank Feeds

Cloud accounting software has a feature that allows bank transactions to be downloaded into your software daily, therefore there is no longer a need to spend hours typing out your statement line by line.

- You can view your companies’ financial position anywhere at any time!

Gone are the days of sitting at your computer to view your company financials; most cloud accounting software such as Xero, QuickBooks and FreeAgent have apps that can be downloaded straight onto your smartphone. You can even take pictures of your receipts and upload them directly to the app whilst you are on the go!

- Cloud accounting software allows multi-user access.

Multi-user access means both you and your accountant can keep up to date with your company financials. Giving your accountant access to this information puts them in the best position to advise you on your financial position throughout your accounting year.

- Cloud accounting software is SPACE SAVING software!

Cloud accounting software such as Xero allows you to store everything in one place. Invoices can be emailed straight into your Xero inbox. You can also attach pictures of your receipts to the relevant expense in the software – not only will you save on printing costs, but you will no longer need endless shelves to store all your invoices, simply snap and upload a picture of your receipts to your software and there is no need to keep the paper copies.

- You will always be logged into the most up to date version of your software.

Cloud accounting software does not need you to download updates each time there are new tax rates announced. Your software will change in line with new government finance guidelines for you.

- Allows for a ‘WORK SMARTER, NOT HARDER’ mindset

Running a business requires a lot of organisation and record-keeping, however, cloud accounting software can do a lot of the tedious bookkeeping work for you. From automatic bank feeds to sending automated reminders to customers that owe you money, there is a whole range of mundane tasks that your software will now complete for you giving you more time to focus on building your business.

- The Cost-Effective Option

In many cases, the ‘cloud’ version of the software is cheaper than their desktop counterparts. This means you’re staying on top of the latest software whilst also saving cash!

- Software that is secure and safe!

As suggested by their name, online software such as Xero, Quickbooks and FreeAgent are all stored ‘in the cloud’. Unlike their desktop friends, they do not need to have regular data backups taken and the data you enter will never be lost!

Each Cloud software allows you the option to set up 2-factor authentication to gain access to the login. This means your business data will be kept safe and can only be accessed by those you allow.

- Data Capturing Software

Software’s such as HubDoc and Receiptbank can be used alongside your software. They use OCR technology to extract the key information from your invoices and feed them into your bookkeeping software. This can save you lots of time as you do not have to manually enter each of your invoices onto your software.

If you need any help or advice on choosing the right cloud accounting software for you please give us a call on 01785 254550.

May 2021 Dates for your Diary

Friday, April 23rd, 2021

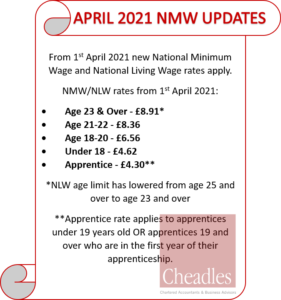

April 2021 National Minimum Wage rates

Thursday, April 1st, 2021

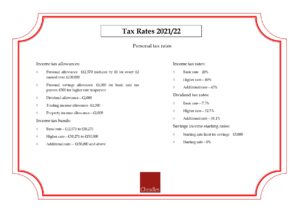

Tax Rates 2021/22

Wednesday, March 31st, 2021

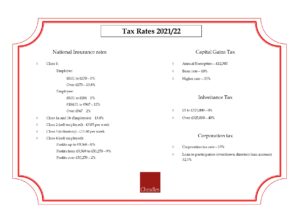

Tax Rates 2021/22

Wednesday, March 31st, 2021

What Is Domestic Reverse Charge

Wednesday, March 31st, 2021What is the domestic reverse charge:

A change in the way CIS registered construction workers handle and pay VAT.

When does it apply:

Domestic reverse charge became effective on 1 March 2021.

Who does it affect:

Individuals or businesses within the CIS scheme who are VAT registered. It applies to standard and reduced rate supplies.

What does it mean for you:

- If you are a subcontractor:

- You will no longer charge VAT to your CIS customers if they are not the end-user of your service (the end-user is the final customer who will not make an onward supply of the building and construction services supplied to them).

- You will need to state on your invoices that the customer is responsible for VAT and show the VAT rate that would apply to your sale.

- The value of the sale will be included in your net sales figure on your VAT return, but no output VAT will be included.

- If your customer is the end-user or your supply is zero-rated, then you will account for VAT in the normal way and the domestic reverse charge will not apply.

- If you are a contractor:

- You will report the VAT from your subcontractors’ invoice as both output VAT and input VAT.

- The net value of the invoice will be reported in your net purchases amount but NOT in your net sales amount.

Impact on your business:

- Cash flow:

- If you are a subcontractor then this change will have a negative impact on your short-term cash flow as you will now be receiving the net amount of your sales invoice rather than the gross. Many businesses rely on the time delay between receiving the VAT element of their sales invoice and paying it over to HMRC. Businesses should, therefore, consider how they will deal with this change.

- If you are a contractor then this change will have a positive impact on your short-term cash flow as you will only be paying the net amount to your subcontractors rather than the gross.

- Accounting systems:

- If you are a contractor then the way you report your purchases from your subcontractors has changed. You will need to ensure that your accounting systems are sufficient to help you deal with this change. Most cloud accounting software is equipped to deal with the domestic reverse charge, so if you are not using cloud software yet then now may be a good time to start.

- Flat rate VAT scheme:

- You cannot account for reverse charge supplies using the flat rate scheme. Reverse charge supplies must be dealt with as outlined above.

- If you are on the flat rate scheme and the domestic reverse charge applies to you then you will need to consider if it is still beneficial for you to remain on the scheme.

- VAT refunds:

- If you are a subcontractor and all, or majority, of your sales, are dealt with through the reverse charge scheme then it is likely that your VAT returns will now result in refunds being payable to you as you will claim the VAT on all your relevant purchases but will have no, or little, VAT to pay over on your sales.

If you need any help or advice on the Domestic Reverse Charge, please do not hesitate to contact us and we will provide all the assistance you need.

April 2021 Dates for your diary.

Tuesday, March 23rd, 2021

Budget 2021

Friday, March 19th, 2021

On 3rd March 2021 Chancellor Rishi Sunak delivered the Spring 2021 budget. There were significant changes announced in a bid to guide the UK on its road to recovery in the coming months and years.

Corporation Tax

From 1st April 2023 corporation tax rates are changing! The current rate of corporation tax is 19% and will be changing as follows:

- For companies with profits inclusive of and exceeding £250,000 the corporation tax rate will increase to 25%.

- Companies with profits of £50,000 or less will continue to pay corporation tax at the existing rate of 19%.

- Companies with profits between £50,000 and £250,000 will pay at a rate on a sliding scale of 19% – 25% dependant on profit levels in the year.

Trading Losses

Currently, trading losses can be allocated against profits of the current year, carried back and offset against profits in the previous year or carried forward against future profits. However, for 2020/21 and 2021/22 only , up to £2 million of tax losses will be able to be carried back and offset against profits for the previous 3 years. This applies to both Companies and Unincorporated businesses

Super Deduction Capital Allowances

From 1 April 2021 until 31st March 2023, Incorporated companies only , investing in new Plant and Machinery will be entitled to claim a ‘super deduction’ of 130% first year capital allowances against profits. Cars, second hand plant and machinery and leased assets are all excluded. Unincorporated businesses are also excluded .

Personal Tax

Personal allowance will increase from the current £12,500 to £12,570 from April 2021. The basic rate threshold will also increase from £37,000 to £37,700 making the new higher rate threshold £50,270 from April 2021. The new rates will then be frozen until March 2026.

VAT

The current VAT registration threshold of £85,000 and the deregistration threshold of £83,000 is to remain in place until 31st March 2024.

All VAT registered businesses will need to be reporting via Making Tax Digital from 1st April 2022. This now includes businesses that are VAT registered but whose revenue has been under the VAT threshold.

If you have any questions, please contact either your client manager or partner by email or by phone.

Budget 2021 Covid Support

Friday, March 19th, 2021

On 3rd March 2021 Chancellor Rishi Sunak delivered the Spring 2021 budget. There were significant changes announced in a bid to guide the UK on its road to recovery in the coming months and years.

Coronavirus Job Retention Scheme

The Coronavirus Job Retention Scheme has been extended until September 2021. From July 2021, the government contribution will reduce from 80% to 70% and for both August and September this will then further reduce to a 60% government contribution. Employees will still need to receive 80% of pay for the hours not worked. Consequently employers will have to fund the remaining 10% and 20% of pay respectively.

Business Rates

During the 2021 spring budget, it was announced that the business rates holiday for certain business sectors, will be extended until the end of June 2021. Following this, the rates will then be discounted until March 2022.

Self-Employment Grants

There were two further self-employment grants announced in the budget. The first can be applied for in April 2021 and will cover 80% of average monthly trading profits up to £7,500. The second grant covering May – July 2021 will be available to those who have suffered a decline in turnover of more than 30%. This will also cover 80% of average monthly trading profits up to £7,500.

VAT

Last year, due to the difficulties caused by Covid-19 , the VAT rate for the hospitality, leisure and entertainment sector was reduced to 5%. This is to remain in place until 30th September 2021. Between 1st October 2021 and 31st March 2022 this rate will increase to 12.5% before reverting back to 20% from 1st April 2022.

VAT payments that were deferred between March 2020 and June 2020 to 31st March 2021 can now be paid in interest free instalments up to 31st March 2022. Applications to do this can be made online and must be completed by 21st June 2021.

If you have any questions, please contact either your client manager or partner by email or by phone on 01785 254550.