Author Archive

Automatic Enrolment Worker Categories

Tuesday, November 15th, 2016Unsure how to classify your workers for Auto Enrolment purposes?

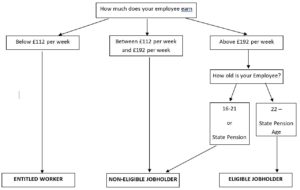

There are three Categories of workers that your staff will fall into:

- Entitled Workers

- Non-Eligible Workers

- Eligible Workers

There are two variables that will decide what category your member of staff falls into.

- Their Age

- Their Earnings

The diagram below will help you categorise your staff: Please note, rates of pay are based on the 15/16 level of earning limits.

<img class="alignnone wp-image-159" src="data:image/gif;base64,R0lGODdhAQABAPAAAP///wAAACwAAAAAAQABAEACAkQBADs=" data-lazy-src="https://cheadle-accounts.com/wp-content/uploads/2016/11/flowchart-300×190.jpg" alt="flowchart" width="666" height="422" data-lazy-srcset="https://cheadle-accounts.com/wp-content/uploads/2016/11/flowchart-300×190.jpg 300w, https://cheadle-accounts.com/wp-content/uploads/2016/11/flowchart-768×487.jpg 768w, https://cheadle-accounts tadalafil for sale.com/wp-content/uploads/2016/11/flowchart-1024×650.jpg 1024w, https://cheadle-accounts.com/wp-content/uploads/2016/11/flowchart-150×95.jpg 150w, https://cheadle-accounts.com/wp-content/uploads/2016/11/flowchart.jpg 1280w” data-lazy-sizes=”(max-width: 666px) 100vw, 666px” />

If you wish for assistance with categorising your staff please feel free to contact us here at Cheadles where we can help guide you through the process.

Further information is available from the pension regulator

HMRC guide explains new home allowance for inheritance tax will work

Thursday, November 10th, 2016<img class=" wp-image-135 aligncenter" src="data:image/gif;base64,R0lGODdhAQABAPAAAP///wAAACwAAAAAAQABAEACAkQBADs=" data-lazy-src="https://cheadle-accounts.com/wp-content/uploads/2016/11/house-illustration-clipart-300×239.jpg" alt="house-illustration-clipart" width="132" height="105" data-lazy-srcset="https://cheadle-accounts tadalafil 5mg.com/wp-content/uploads/2016/11/house-illustration-clipart-300×239.jpg 300w, https://cheadle-accounts.com/wp-content/uploads/2016/11/house-illustration-clipart-768×612.jpg 768w, https://cheadle-accounts.com/wp-content/uploads/2016/11/house-illustration-clipart-1024×815.jpg 1024w” data-lazy-sizes=”(max-width: 132px) 100vw, 132px” />

HMRC have published a new guidance explaining how the residence nil rate band (RNRB), or home allowance, for inheritance tax applies in most circumstances.

An estate will be entitled to the RNRB if the:

• individual dies on or after 6 April 2017

• individual owns a home, or a share of one, so that it’s included in their estate

• individual’s direct descendants such as children or grandchildren inherit the home, or a share of it

• value of the estate isn’t more than £2 million

An estate will also be entitled to the RNRB when an individual has downsized to a less valuable home or sold or given away their home after 7 July 2015.

The maximum available amount of the RNRB will increase yearly .

More details are available here

If you would like to discuss the above please call Cheadles accountants in Stafford on 01785 254550

The New Charities SORP

Wednesday, November 9th, 2016The Statement of Recommended Practice – Accounting and Reporting by Charities (SORP 2015) is now in force for accounting periods starting on or after 1 January 2015 More about the author.

The changes to the SORP stem from the new accounting framework FRS 102. The main changes to the new SORP are as follows:

There are now two SORP’s – Charities SORP (FRSSE) and Charities SORP (FRS 102). This is to reflect the two different accounting frameworks that apply to charities from 1 January 2015. Which SORP you use depends on individual circumstances.

SORP 2015 now uses a modular approach. This is designed to make it easier for charities to focus on those areas that particularly concern them.

SORP 2015 specifically uses the words “must”, “should” and “may” to make it easier to distinguish between accounting policies that are compulsory, recommended and suggested.

The Statement of Financial Activities (SOFA) has been simplified. The number of headings for income has been reduced from six to five, and the number of headings for expenditure has been shortened from seven to three.

The majority of the other changes to the SORP stem from FRS 102. Full details can be found on the Charity Commission Website

Should you require any assistance with the new charities SORP or the new FRS102 accounting framework, then please call Cheadles accountants in Stafford on 01785 254550.

FRS 102 Accounting Standard

Wednesday, November 2nd, 2016The new accounting framework for small companies will become mandatory for accounting periods starting on and after 1 January 2016, and is known as FRS 102. This new framework was introduced to provide one single set of accounting policies for businesses to follow and policies which are more in-line with international standards.

Companies do have the option to early adopt the new framework, but this depends on individual circumstances.

Once FRS 102 applies to your business, it is not just the current year that is affected. The previous comparative figures also need to be adjusted for any change in accounting policies.

Some examples of the changes to the accounting framework include the valuation of investment properties, dealing with short-term employment benefits (accrued staff holidays not taken at the year end), shortened the useful life of goodwill, dealing with lease incentives and further rules regarding the calculation of deferred tax.

It is vital that these changes be properly thought through as they could have a significant impact on the results of the business, which will be filed on the public record and used to determine credit scores.

Should you require any help and assistance with regards to the transition to FRS 102, and indeed ways to improve your credit score, please call Cheadles accountants in Stafford on 01785 254550.

Xero – the next step for your bookkeeping

Tuesday, November 1st, 2016Xero is a cloud-based approach to bookkeeping. It streamlines the most mundane parts of your book-keeping that every business loathes to do!

One of the prime features of Xero is the bank feed features. With some banks this can be done autonomously, with others it is a simple upload of the month’s transaction via a csv file. Then all that needs doing is tying up the transactions, which after a few months Xero starts learning where things have historically gone so starts to suggest items making reconciling your bank a breeze!

Another fantastic function of Xero are the sales features. You can email quotes to your customers who can approve them or discuss them online. You are notified when they have been approved so that you can convert them into sales invoices. These sales invoices can then be emailed direct to your customer, and you have the option to add a pay here button, so customers will be more inclined to pay straight away! Finally, if you have troublesome customers who do not pay, you can set Xero to forward reminder emails to ask for payment; this way clients will be continuously reminded and should start to pay you more promptly.

For those businesses who are continuously losing their purchase invoices Xero can help you. There is an option to upload files to Xero, which means you can take pictures of your invoices, upload them and then if they go missing you already have a copy in your bookkeeping! You can even go one step further and ask suppliers to email a unique email address which will automatically upload the invoices to your Xero account.

For those of you that wish to see your book-keeping on the go, there is even an App available for Android and Apple users. From this app you can send sales invoices, reconcile your bank and even upload your personal expenses for the business by taking a picture of the invoice for your cup of coffee or train ticket!

As you can see here at Cheadles, we are very excited by Xero, if you wish for a short demo we are happy to show you how it can help your business in ways, you will not have thought of tadalafil 10mg. Contact us on 01785 254550 to arrange a demo at our offices near Stafford Town Centre. Or read further information on Xero

Auto Enrolment – are you Ready?

Tuesday, November 1st, 2016Most businesses are now fully aware of The Work Place Pension being rolled out but may not be so sure of their Auto Enrolment duties click site.

The first step for all employers to make is to find out their staging date. The Pension Regulator should notify you of this by letter, however it can also be found on their website.

Once you have found out your staging date, you can start planning your approach to Auto Enrolment.

You need to review your staff’s earnings and age to work out what type of worker they are. If any fall under the Eligible Jobholder category you need to have a scheme ready before your staging date. If your workers fall into the Non-Eligible Jobholder category, you may still need a scheme.

You need to decide what Pension Provider you wish to use for the company’s scheme. If you already have an existing scheme in place you can contact your pension provider and enquire to whether it is a Qualifying Scheme or not, if it is they will be able to advise you on what help they can offer. Otherwise, you will have to research other schemes available to you. This may require help from your accountant or an Independent Financial Advisor to ensure you find the best scheme for your business.

Once you have decided on the scheme; be it NEST, Peoples Pension or even one of the larger providers such as Royal London you then need to activate the scheme.

If it is a NEST scheme, Cheadles can help you with this. If it is a different scheme we can still advise you on what needs to be done.

Finally once the scheme is active and you approach your staging date you will need to enrol your workers into the scheme, and deduct the appropriate amounts from their net pay.

The above is just a simple overview of the stages of Auto Enrolment; however, there is much more involved in the process.

Here at Cheadles we are in a prime position to offer a more tailored advice to your business and help you understand your legal obligations to your staff about Auto Enrolment. Please feel free to contact us to discuss your needs on 01785 254550. We can arrange for you to meet us in our office located near Stafford Town Centre or we can arrange a meeting at your premises.

Farmer Averaging Rules

Tuesday, November 1st, 2016Announced in the March 2015 budget and brought into effect from April 2016, farmers have been given greater flexibility with an extension to the two-year farmers averaging rules. The new rules that allow farmers the option to average profits over five years will run alongside the existing two-year averaging system. With farmer’s profits often affected by uncontrollable external factors like the weather, a year of high profits can often be followed by a year of losses. It is hoped that the new option will increase tax planning abilities in these situations.

The relief is also available to market gardeners and the term ‘farming’ includes the intensive rearing of livestock or fish on a commercial basis for the production of food for human consumption.

The general rules will still stay the same where relief is only available to sole traders and partnership. It is not available to companies or those using the cash basis and calculations are done on an individual basis. This means calculations should be on individual partners rather than the partnership as a whole. Claims cannot be made in the year of commencement or cessation and losses will still be treated as NIL profits.

To claim relief over five years a ‘volatility condition’ still needs to be met, this is done retrospectively. The original two-year rules gave full relief if the profits of one year were 70% or less than the other and marginal relief where profits were between 70% and 75%.

The ‘volatility condition’ requires the four previous year’s profits to be averaged and compared to the current claim year profits tadalafil over the counter. If one profit is 75% or less than the other a claim can be made, marginal relief no longer applies.

Five-year averaging will require an increase in time-consuming and complicated calculations, however, may not lead to greater tax savings. It is believed there will need to be large fluctuations in profits for the new five-year rules to be beneficial. Averaging will need to be carefully considered especially with possible changes to subsidies and support following Britain’s exit from the EU.

If Cheadles Chartered Accountants in Stafford can be of assistance with any of the above please call on 01785 254550