Archive for the ‘P11D’ Category

Should I put my car through my Limited Company?

Tuesday, July 13th, 2021Believe it or not, this is not as straightforward a question as it may seem. There are many factors to consider when deciding whether to put your car through your Limited Company.

Here is a summary of some of the key factors:

- If you use the vehicle privately, you will pay tax on the company car

- A company vehicle is classed as a benefit in kind and taxed both on the company and personally.

- The value of the benefit is a percentage of the list price of the vehicle. The percentage is based on the CO2 emissions. The higher the emissions, the higher the benefit.

- Your company will pay 13.8% National insurance on the benefit.

- The value of the benefit will be treated as additional income on you personally. You will be taxed on this based on the tax bracket that your income falls into.

- Is the cost of the vehicle tax deductible?

- This is dependent on whether you will be leasing the car or buying it.

- If you are leasing the car, then the monthly lease costs are an allowable tax expense, and so you will get tax relief on these costs. However, this will be limited to 85% of the cost if the car has CO2 emissions above 50g/km.

- If you are purchasing the car, then you get tax relief by claiming capital allowances. The rates of capital allowances on cars are as follows:

- Electric cars or CO2 emissions of 0g/km – 100% relief in the year of purchase

- CO2 emissions of 1-50 g/km – 18% relief per year

- CO2 emissions above 50g/km – 6% per year

- This is dependent on whether you will be leasing the car or buying it.

- Can you claim the VAT?

- Again, this is dependent on whether you are leasing or purchasing the car.

- If you are leasing, then you can claim all of the VAT back if the car is used 100% for business. If you use the car privately, then you can claim 50% of the VAT back on your monthly lease payments.

- If you purchase a car and use it 100% for business, you can claim the VAT back. However, if you use the car privately, you cannot claim any VAT back on the car’s purchase price.

- In both instances, to be classed as 100% business use, the vehicle must not be made available for private use, and you must be able to show that this is the case (i.e. in an employment contract). Travelling from home to your place of work would class as personal use.

- Again, this is dependent on whether you are leasing or purchasing the car.

- What about the running costs?

- Insurance, car tax and general repair costs are all tax allowable costs if your car goes through your Limited Company

- Fuel is also an allowable cost but is a taxable benefit in kind and will be taxed in a similar way to the cost of the car (as mentioned in point 1) unless only fuel for business use is claimed.

- What can you claim if you don’t put your car through the company?

- You can claim business mileage for any business miles you do in your personal vehicle.

- The rates for business miles are 45p per mile for the first 10,000 miles and 25p per mile after that.

- Insurance, tax, repairs and fuel are all covered by the mileage rate, so you cannot claim these costs on top of the mileage.

- What about vans?

- If you buy a commercial vehicle, such as a van, then different rules apply.

- You can claim the full cost of the van (or monthly leasing payments) in the year of purchase by claiming AIA.

- You can claim the VAT back

- If you use the van personally, you will be charged a benefit in kind, but this is a set amount each year and is not based on the vehicle’s list price. For 2021/22 this amount is £3,500.

As you can see, there are many things to consider when deciding whether to put your vehicle through your Limited Company.

As a general guide, then it is not usually beneficial to put a vehicle through the company unless it is a commercial vehicle or has very low CO2 emissions, but each case is different.

Please get in touch with your client manager if you are considering purchasing a new vehicle, and they can advise you on whether you should purchase through your Limited Company or not.

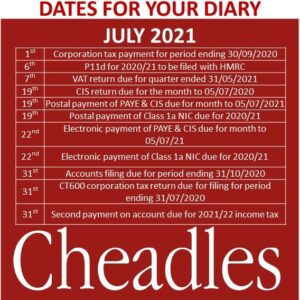

July 2021 Dates for your Diary

Thursday, June 24th, 2021

Payrolling Benefits; An employer’s guide to payrolling employee benefits

Tuesday, June 22nd, 2021Payrolling Benefits; An employer’s guide to payrolling employee benefits

In 2016 HMRC introduced the option for employers to payroll employee benefits in kind. This allows employers to process employee’s benefits through payroll and pay tax on the deduction throughout the year rather than submitting and paying it via a P11D at the end of the tax year.

A benefit is an additional payment given to an employee by their employer that is not part of their usual salary. This may include things such as payments for a company car or medical benefits.

Employers may wish to offer these benefits as a reward to employees for years of service or simply to make a role more attractive to prospective employees.

Advantages of Payrolling Benefits

- P11D forms will no longer need to be filled out for each employee. This reduces end of year administration for the employer. (Class 1a NIC still needs to be calculated and reported via a P11D(b) form)

- Employees are more likely to pay the correct tax that is due on their benefits throughout the year. By payrolling benefits monthly, it is more likely that PAYE tax codes will be updated timely and efficiently by HMRC, leading to less chance of underpaid liabilities at the year-end.

- Employees tax payments are spread out across the year rather than one big lump sum tax payment being made at the end of the tax year.

- Your employees can see all benefits listed on their payslips.

Disadvantages of Payrolling Benefits

- The benefit value and tax must be calculated correctly and accurately during the tax year.

- Any changes to the benefit value during the year must be tracked, and the taxable values must be amended accordingly in the relevant pay period to avoid HMRC Penalties.

- You have to wait until the end of a tax year if you wish to cease payrolling a benefit (unless an employee leaves your employment).

Which benefits are taxable?

There are many employee benefits that can be payrolled; some of these will be subject to tax and national insurance deductions.

Here are some examples of taxable benefits:

- Company cars that are also used for private use

- Fuel that is subject to private use

- Medical and dental insurance

- Mobile Phones

- Gym memberships

Here are some examples of non-taxable benefits:

- Living accommodation

- Training

- Low interest/Interest-free loans

Non-taxable benefits still need to be declared to HMRC via a P11D.

Here is a link to the HMRC website that lists all benefits and will give you further information as to whether they are taxable. https://www.gov.uk/expenses-and-benefits-a-to-z

The 50% rule

Benefits cannot be paid to an employee if the tax on this benefit constitutes to more than 50% of their salary. For example, if an employee were paid maternity pay and this meant their salary was less than usual, payrolling of the benefit would need to stop during that time and instead, reported on a P11D at the year-end. This would then allow HMRC to incorporate the tax due in the employee’s following year tax code.

DEADLINES

If you would like to start payrolling benefits, you must register with HMRC before 5th April of the year in which the benefit will relate to. You can do this by filling in an online form through your HMRC government gateway account.

Employees must be notified of the benefits and what it means for them before the benefit is processed via the payroll.

Class 1A NIC must be calculated and reported via a P11D(b) form to HMRC by 6th July of the following year that in which the benefits relate to.

The Class 1A NIC due per the P11D(b) form must be paid to HMRC by 19th July (22nd July if paying electronically) following the tax year in which the benefits relate to.

For example, any benefits that were payrolled in the 2020/2021 tax year must be submitted via a P11D(b) by 6th July 2021 and paid by 19th July 2021.

If you need any advice or further information regarding employee benefits, please give us a call on 01785 254550.

A Guide to P11D’s

Friday, June 11th, 2021A guide to employee benefits that must be reported on a P11D:

The P11D is used to tell HMRC about the cash value of any expenses and benefits that don’t go through payroll.

Anything the company pays for or buys for the direct benefit of an employee should be included.

The most common benefits that are reportable on a P11D include:

- Company cars and vans where there is an element of private use.

- Medical or dental treatment and other forms of insurance.

- Mobile phones and internet where there is private use (unless the contract is in the company name)

- Low interest or interest-free loans in excess of £10,000.

- Gym memberships.

- Accommodation provided to employees.

- Assets sold or given away to employees.

You don’t have to report certain business expenses and benefits like business travel & entertaining, phone bills, uniform & tools for work as long as you are re-imbursing in one of the following ways:

- paying a flat rate to your employee as part of their earnings – this must be either a benchmark rate or a special (‘bespoke’) rate approved by HMRC

- paying back the employee’s actual costs

The deadline to submit a P11D for 2020/21 is 6th July 2021.

If you need any advice on employee benefits or think you may have to submit a P11d, please get in touch.