Archive for the ‘Uncategorized’ Category

A guide to Research and Development (R & D)

Tuesday, May 3rd, 2022R & D is a Corporation Tax (CT) tax relief that may reduce your company’s tax bill, or, in some circumstances, you may receive a payable tax credit.

It applies to small and medium-sized companies (SME). To qualify as an SME the following conditions must apply:

- Less than 500 employees

- Turnover of less than €100million

- Balance sheet total of less than €86million

What is R & D Relief:

For tax purposes, R & D takes place when a project seeks to achieve an advance in overall knowledge or capability in a field of science or technology.

There are two schemes available:

- The SME scheme

- A company can get 230% tax relief on their qualifying R & D costs. Loss-making companies can, in certain circumstances, surrender their losses in return for a payable tax credit

- Research and Development Expenditure Credit (RDEC) scheme

- A taxable credit is available at 11% of qualifying R & D expenditure. For loss-making companies, the tax credit is fully repayable.

- Companies with no CT liability will benefit from RDEC either through a cash payment or a reduction of tax or other duties due. The payable credit is limited to the Company’s PAYE/NIC liabilities of the staff engaged in qualifying activities.

What qualifies as R & D

Work that advances overall knowledge or capability in a field of science or technology, and projects and activities that help resolve scientific or technological uncertainties, may qualify for R &D relief.

This can include creating new processes, products or services, making appreciable improvements to existing ones, and even using science and technology to duplicate existing processes, products and services in a new way. But pure product development in itself does not qualify.

Examples include software development, engineering design, new construction techniques, bio-energy, cleantech, agri-food and life and health sciences.

What costs qualify

- Direct R &D staff costs – salaries, wages, class 1 NIC and pension contributions for staff directly and actively engaged in the R & D project.

- Externally provided R & D staff – These are the staff costs paid to an external agency for staff who are directly and actively engaged in the R & D project (not employees or subcontractors). Relief is usually given on 65% of the payments made to the staff provider.

- Subcontracted R & D

- SME scheme – 65% of payments made to unconnected parties can generally be claimed.

- RDEC scheme – not generally allowable unless it is directly undertaken by a charity, higher education institute, scientific research organisation or health service body – or by an individual or a partnership of individuals.

- Consumable items – Cost of items that are directly employed and consumed in qualifying R & D projects

- Software – Cost of software that is directly employed in the R & D activity.

- Prototypes – Where a prototype is created to test the R & D being undertaken, the design, construction and testing costs will normally be qualifying expenses, unless the prototype is built with a view to selling it.

What costs do not qualify

- Production and distribution of goods and services

- Capital expenditure

- Cost of Land

- Payments for the use and creation of patents and trademarks.

How to claim R & D tax relief

R & D relief is claimed via the Company Tax Return Form, CT600.

More detailed guidance can be found on the HMRC website here:

http://www.hmrc.gov.uk/gds/cird/attachments/rdsimpleguide.pdf

If you need any advice or you feel that you may be eligible for R & D relief then please get in touch and we can help you with your claim.

Construction Industry Scheme

Thursday, March 3rd, 2022- What is it?

- A tax applied to certain construction workers. Tax is deducted from money paid over to a subcontractor at source and they receive the ‘net payment’

- Who does it apply to?

- All construction work in the UK including jobs such as:

- Site preparation

- Alterations

- Dismantling

- Construction

- Repairs

- Decorating

- Demolition

- It applies to all businesses – Sole trader, partnership & Limited Company

- The scheme only applies to companies who are providing work to other businesses not individuals.

- All construction work in the UK including jobs such as:

- Contractor:

- You are classed as a contractor if you pay someone to complete construction work on a job you are doing (a subcontractor)

- You must register as a contractor with HMRC and complete monthly CIS returns declaring the payments and tax deducted from all your subcontractors.

- Contractor must ‘verify’ each subcontractor – if verified then 20% tax will be deducted. If not verified, then 30% will be deducted.

- CIS tax due is payable to HMRC every month

- Subcontractor:

- You are a subcontractor if you are completing construction work for a contractor.

- You will have CIS tax deducted from your income – i.e you will receive the net amount.

- You should be provided with monthly statements from your contractors confirming the amount of CIS tax deducted.

- How to calculate the CIS tax:

- Gross amount less VAT (incl any expenses reimbursed to the subcontractor i.e accommodation, fuel for travel, mobile phone etc)

- Deduct any payments made by the subcontractor for the following items:

- Materials

- Consumables

- Fuel used for machinery – not fuel for travelling

- Plant hire

- Calculate 20/30% of the net figure

- How do subcontractors get the tax back?

- Sole traders/partnerships – The amount of CIS deducted in a tax year is entered onto their tax return and is deducted off the total tax payable. It will either reduce the tax they owe or will result in a refund which will be issued by HMRC once the tax return has been processed.

- Limited Companies – CIS is dealt with via payroll. The amount is deducted from any PAYE/NI and CIS tax due. This will either reduce the liability to pay over or will result in a refund being due. A refund should be issued at the end of the tax year via the year end payroll reports.

Are you missing out on help towards your childcare costs? – A guide to Tax-Free Childcare

Thursday, February 3rd, 2022Tax-Free Childcare is a government scheme that pays 20% of childcare costs up to a maximum of £2,000 each year. Tax-Free Childcare is a UK-wide scheme covering England, Scotland, Wales and Northern Ireland.

For every £8 paid into an online account, the government adds an extra £2, up to £2,000 per child per year (£4,000 for disabled children). It is available for children under the age of 12 (under the age of 17 if the child is disabled).

To be eligible you, and your partner, must be over 16 and each expect to earn at least £142 per week on average. The scheme is not available if you, or your partner, expects to individually earn £100,000 or more.

Please be aware this limit is based on individual earnings and not your combined income.

This scheme can be used in conjunction with both the 15 and 30 hours free childcare.

However, you will not be eligible for the scheme if you are receiving universal credits or tax credits or if you are part of the childcare voucher scheme.

You can use Tax-Free Childcare all year round to spend on regulated childcare, such as:

- Childminders, nurseries and nannies

- Before and after-school clubs and holiday clubs

You can apply for the scheme on the following link:

https://www.gov.uk/apply-for-tax-free-childcare

Sole Trader vs Limited Company

Thursday, February 3rd, 2022Sole Trader:

What is a Sole Trader?

- A sole trader is a self-employed person who is the sole owner of a business.

- The profit or loss of a sole trader is reported on a self-assessment tax return with HMRC.

- Profits will be taxed using income tax rates after the personal allowance has been utilised – currently 20/40/45% dependent on your total level of income in a tax year.

- You will pay Class 2 National insurance of £3.05 per week if your profits exceed £6,515.

- You will also pay Class 4 National Insurance of 9% on profits between £9,569 and £50,270 and 2% on profits in excess of £50,270

Advantages of being a sole trader:

- It’s easy to set up and involves very little paperwork

- None of your documents are available to view on the public record and so remain completely private

Disadvantages of being a sole trader:

- You are personally liable for any debt owed therefore your personal belongings and property are at risk

- Banks and other lenders can often prefer Limited Companies so raising finance can be a little more difficult.

- Once you reach a certain level of profits (usually around the £30,000 mark) you will pay more tax than if you operated as a limit company

Limited Company:

What is a Limit Company?

- A Limited Company is a business that is an entity in its own right. It is separate from the people that own and run the business.

- Usually, the owners of the business will have shares in the Company, and it will be run by the directors of the Company. A person can be both a shareholder and a director.

- A Limited Company must be registered with Companies House and follow the rules of the Companies Act.

- A set of annual accounts and an annual confirmation statement must be filed with Companies House and a CT600 tax return must be filed with HMRC.

- Profits are taxed using the rates of corporation tax – currently 19%.

Advantages of a Limited Company:

- The company is a separate legal entity therefore you are only liable for the investment you made in the business.

- Banks and other lenders are often more willing to lend to Limited Companies

- Above a certain level of profits (usually around £30,000) – you will pay less tax than a sole trader. The higher the levels of profits the more tax you will save.

Disadvantages of a Limited Company:

- Limited Companies have more responsibilities and more paperwork to complete than sole traders. This often leads to an increased cost in accountancy fees.

- Certain information is available on the public record with Companies House.

There is no definitive answer as to whether you should be a Sole Trader or a Limited Company as each person’s needs are different. If, having weighed up the pro’s and cons of each, you are still unsure which option is right for you then please get in touch with us and we can help you make the right decision for you and your business.

What items can I reclaim VAT on?

Thursday, January 13th, 2022You can usually reclaim the VAT paid on goods and services purchased for use in your business.

If a purchase is also for personal or private use, you can only reclaim the business proportion of the VAT.

You must have a copy of the VAT receipt to reclaim the VAT.

There are some typical business costs that are either VAT exempt or zero-rated. This means you will not have been charged VAT, and therefore you cannot claim it back. These should be included in your net purchases figure on your VAT return.

Typical examples of this include:

- Exempt Expenses:

- Insurance

- Postage

- Loan and Finance costs – including bank charges

- Subscriptions to professional bodies

- Zero-rated expenses:

- Water rates

- Books

- Public transport including train travel and flights

There are also some business costs that are ‘outside the scope of VAT’. This means that VAT doesn’t apply to them at all. These costs should not be included on your VAT return.

Examples of these include:

- Wages and Salary payments

- Payments to Subcontractors

- Loan and hire purchase payments

- Council tax and business rates

- MOT tests

- Road tax

- Drawings

Certain business costs have specific rules in regard to VAT:

- Entertaining:

- Staff Entertaining:

- Only employees – VAT can be reclaimed

- Only Directors or partners of a business – VAT cannot be reclaimed (If directors or partners are in attendance for entertaining of other employees then the VAT can be reclaimed)

- Mixture of employees and non-employees (for example if employees partners attend) – You can only reclaim the VAT on the portion of the costs that are for entertaining staff.

- Client or other business entertaining – VAT cannot be reclaimed

- Staff Entertaining:

- Vehicle Costs:

- Purchasing a new car:

- VAT cannot usually be reclaimed on the cost of a new car unless it is used entirely for business purposes with no personal use (travel from home to work is classed as private use)

- Leasing a car:

- You can usually reclaim 50% of the VAT on a car lease.

- You can claim all of the VAT if you use the car entirely for business purposes with no personal use

- Buying a commercial vehicle:

- You can usually claim the VAT on a commercial vehicle if it is used entirely for business.

- Fuel – There are 3 options for how to reclaim the VAT on fuel costs:

- Reclaim VAT on all fuel costs and pay a fuel scale charge

- Only reclaim the VAT on the fuel you use for business trips

- Don’t claim any VAT on your fuel costs

- Additional costs:

- Repairs and Maintenance – VAT can usually be claimed

- Motor Insurance – Exempt expense

- Road tax and MOT – Outside the scope of VAT

- Purchasing a new car:

If you need any advice or would like our help in completing your VAT returns, please get in touch.

How can businesses reduce their Carbon Footprint?

Wednesday, December 8th, 2021With climate change at the forefront of people’s minds, many businesses want to do everything they can to reduce their carbon footprint.

Here are some of the ways in which a business can reduce its carbon emissions:

- Reduce, reuse & recycle:

- Encourage your workforce to limit the amount of waste they are throwing away

- Send emails instead of letters. This reduces the use of paper as well as the carbon produced from delivering the mail.

- Limit the amount of paper being printed where possible – using a document storage system can help

- Set printers to print double-sided

- Have separate bins for general waste and recycling and implement recycling collection wherever possible

- Recycle toners and print cartridges

- Provide reusable cups and glasses for people rather than use disposable ones

- Re-use any packaging or boxes that come into your business

- Use recycled products, such as paper, where possible

- Reduce your travelling:

- Switch to online meetings and events – these have been used extensively during the lockdowns. By keeping these in place you can significantly cut down on road and air travel.

- Allow your staff to work from home wherever possible to reduce the need for commuting

- Use public transport or car share for business meetings

- Switch to hybrid or fully electric company cars – there are some great tax incentives in place for Limited Companies purchasing electric cars

- Use greener energy and office equipment:

- Install solar panels to power your business

- Use LED lighting and turn off the lights when you leave the room

- Use motion sensors and dimmable lights to reduce the need for unnecessary lighting

- Purchase kitchen equipment that has high energy ratings

- Use energy-saving modes an all PC’s

- Minimise the use of single-use plastic:

- Implement alternative packaging for your products wherever possible

- Plant trees:

- If your work premises has the space, then planting trees or wildflowers is a great way to offset your carbon emissions.

- Creating an outdoor space that your employees can enjoy is also a great way to boost your staff’s well-being.

A guide to Christmas gifts and parties for your employee

Wednesday, November 10th, 2021With the festive season fast approaching, we thought a quick reminder of the tax implications of Christmas gifts and staff parties would be beneficial.

When employers provide additional benefits to their employees then they may be liable to additional tax and National Insurance on a benefit in kind.

Benefits in Kind are reportable on a P11d and an employer will pay Class1A National Insurance, while an employee will pay additional tax on the benefit.

There are certain exemptions regarding staff parties and gifts that mean there will be no benefit in kind implications.

Staff Parties

There is a tax exemption on employee entertaining if the following conditions are met:

- It is an annual party or social function

- It is available for all employees (or employees based at the same location)

- The cost does not exceed £150 per head

The cost of the party includes all costs associated with the event including food, drink, taxi’s home etc. and should be divided by the total number of guests at the party.

If the cost exceeds £150 per head, then the total cost is taxable not just the excess.

Staff Gifts

A trivial benefits exemption means you don’t have to pay tax on a benefit to your employees if all of the following conditions are met:

- It costs £50 or less to provide

- It isn’t cash or a cash voucher (gift cards are fine as long as they aren’t exchangeable for cash)

- It isn’t a reward for their work or performance

If you are a director of a close company you cannot receive trivial benefits totalling more than £300 in a year

Cash, cash vouchers and Christmas bonuses

These are all classed as additional earnings and must be reported as such through payroll and PAYE and National Insurance will be payable.

Budget October 2021

Thursday, October 28th, 2021On 27th October 2021 Chancellor Rishi Sunak delivered the Autumn 2021 budget. Whilst this budget was more focussed on spending, there are a few key points from this budget and previously announced tax rises.

The Health and Social Care Levy:

- A levy of 1.25% will be added to Class 1 (employers and employees) and Class 4 National Insurance contributions. This levy will apply from April 2022.

Personal tax rates on dividends:

- Tax rates payable on dividend income will increase by 1.25% from April 2022. The rates will therefore be 8.25% for basic rate taxpayers, 33.75% for higher rate taxpayers and 39.35% for additional rate taxpayers.

- The first £2,000 of dividend income is still tax free.

Business rates:

- Businesses in the retail, leisure and hospitality sector will receive a 50% reduction on business rates up to a £110,000 cap.

National living wage:

- From April 2022 the National Living wage rates will increase as follows:

- For people aged 23 or over – £9.50 per hour

- For people aged 21 or 22 – £9.18

- For people aged 18 – 20 – £6.83

- For people aged 16 or 17 and the apprenticeship rate – £4.81

Reporting of Capital Gains on residential property:

- The 30 day time limit for reporting and paying capital gains on the sale of residential property has been increased to 60 days.

- This was effective from 27 October 2021, meaning any sales that were completed on or after 27 October now have 60 days to report the gain and pay the capital gains tax.

Profit Vs Cashflow – What’s the difference?

Thursday, October 14th, 2021Cashflow and profit are very different. Business owners can often be confused into believing they are highly profitable because they have a large amount of cash and vice versa.

It is important to understand the difference between the two concepts.

What is cashflow?

The money that comes into, through and out of your business. It doesn’t include money owed to you from customers or credit from suppliers.

Insufficient cashflow means a business can’t meet its financial obligations such as paying suppliers or employees.

What is profit?

Profit is how much is left of your revenue once all costs have been deducted. It includes all income and costs that are due but not yet received or paid.

A business cannot survive in the long term if it is not profitable.

What is the difference?

The key difference between profit and cashflow is time.

Profit takes account of transactions as they are generated whereas cashflow takes account of transactions as they are paid or received.

As an example:

- A company sells goods for £1,000 on 31 March, but does not receive the money from the customer until 30 April

- Materials were purchased to produce these goods costing £250. The supplier was paid on 31 March for these materials.

- At 31 March:

- Profit:

- Sales – £1,000

- Materials – (£250)

- Gross profit – £750

- Tax @ 19% – £142.50

- Net profit after tax – £607.50

- Cashflow:

- Cost of materials – (£250)

- Net Cashflow – (£250)

- Cost of materials – (£250)

- Profit:

In the above example, at 31 March, the company has a positive profit but a negative cashflow.

The cashflow does not become positive until 30 April when the money is received from the customer.

Understanding this key difference can be crucial in keeping your business going.

A business can be highly profitable but if customers are on a 90 day payment term but suppliers are a 30 day payment term then you may not have the cashflow to keep the company going.

If you would like any assistance in understanding your profit and cashflow or would like a cashflow forecast preparing, please get in touch with us.

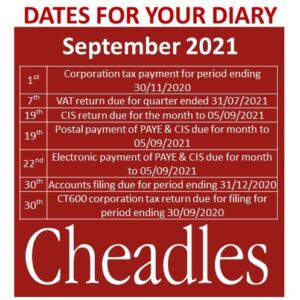

September 2021 Dates for your Diary

Monday, September 13th, 2021