Archive for the ‘VAT’ Category

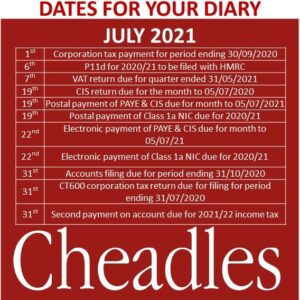

July 2021 Dates for your Diary

Thursday, June 24th, 2021

Exporting from the UK to the EU Post Brexit.

Friday, March 19th, 2021Exporting from the UK to the EU Post Brexit.

Here’s what you need to know, or setup, before exporting goods from the UK following our exit from the EU.

EORI number

You’ll need a UK EORI number beginning with GB or XI to export goods out of the UK. But you’ll also need to know the EU EORI number for the European business you’re exporting to.

Commodity codes

The importer in the EU will need to pay tax and duty on what you export to them. Therefore, it’s important to ensure you use the correct commodity codes.

Export declarations

As with importing, the government suggests you hire a freight forwarder, customs broker or fast parcel operator for making customs declarations. If making declarations yourself, you’ll need to register for and use the National Export System (NES), which will let you make declarations electronically. You’ll need what’s known as a CHIEF badge role.

Export licences

Some goods require export licences, and there are additional rules specific to alcohol, tobacco and certain oils, and for controlled goods. You’ll need to ensure you have these in place prior to export.

Incoterms

Businesses should review the commercial terms of trade (Incoterms) in contracts relating to delivery of goods for those you export to. These will help you to understand who is responsible for customs duties, import VAT and any additional insurance and transportation costs.

Transporting goods

Businesses can utilise commercial goods transportation services, which is certainly the easiest option, or opt to use their own transport.

Trade tariffs

Your customers in the EU may now have to pay tariffs when they import from you, when previously they didn’t need to do so. This will need to be part of your pricing calculations, and you might find it impacts demand.

You should discuss this issue with your clients so that it doesn’t come as a shock to them or cause their goods to be held in local customs.

VAT on exports:

VAT on export of goods:

As of 1 January 2021, when it comes to exporting goods to EU countries, the VAT situation also changes. Exports to EU countries are treated like those to non-EU countries, which is to say, they should be zero-rated for UK VAT.

This will apply regardless of whether you’re exporting goods to a consumer (B2C), or to a business (B2B).

This could mean businesses selling B2C to the EU need to register for EU VAT and appoint fiscal representatives depending on the requirements of the countries in which they sell.

VAT on sale of services:

When it comes to purchasing services, rather than goods cross-border, things continue much as they did before 1 January 2021.

Under the place of supply rules:

- B2B sales of services will continue to be generally subject to tax in the country of the customer and administered through reverse charge, with some exceptions. – No VAT charged but included in Box 6.

- B2C sales of services will continue to be generally subject to tax in the country of the seller, again with some exceptions. – VAT charged in normal way

VAT on sale of digital services:

All sales of digital services are subject to tax in the country of the customer.

UK businesses that use the Mini One-Stop Shop (MOSS) system will need to register for the non-union MOSS and will no longer benefit from a €10k threshold before having to apply the place of supply rules.

This means many more businesses may be liable to VAT in the countries they sell digital services to and will need to register for non-union MOSS.

VAT will need to be charged at the rate applicable in the country of the customer.

Importing from the EU to the UK Post Brexit

Friday, March 19th, 2021Importing from the EU to the UK Post Brexit

Here’s what you need to know, or setup, before importing goods from the EU after the end of the transition period (1 January 2021).

Delaying customs import declarations for up to six months

For most goods, there’ll be no need to make immediate import declarations for goods at the UK border, or get authorisation in advance. This will be the case for six months, from 1 January 2021 to 30 June 2021.

The exceptions are if the goods are controlled (such as alcohol, tobacco and hydrocarbon products), or if HMRC has explicitly said you can’t use this scheme. This might be the case if your business has a poor record in other areas of compliance.

Most businesses will rely on their customs broker or freight forwarder to make the customs declarations. But if you do this yourself, rather than via a third party, you’ll need to be registered for the CHIEF system (known as getting a CHIEF badge), and have CHIEF-compatible software.

EORI number

An Economic Operators Registration and Identification (EORI) number is a way of identifying businesses or operators who export or import to the EU. It will be required for both customs and VAT documentation.

UK businesses will need one or more of three different types of EORI number as of 1 January 2021, depending on where you import and export:

- Business in Great Britain: To trade goods with EU countries, you’ll need an EORI number that starts with GB.

- Businesses moving goods to or from Northern Ireland: If you move goods to or from Northern Ireland (outside of moving goods to the Republic of Ireland), you’ll need a second EORI number that starts with XI.

- Businesses making declarations or getting customs decisions in EU countries: If your business makes declarations or gets customs decisions in an EU country, you’ll need to get an EORI from the customs authority in the EU country where you submit your first declaration, or request your first decision.

Commodity codes

Customs relies on the correct classification of goods so the correct tariff and quota can be applied. Different parts of the world call the classification code different things.

Within the EU and UK, these codes are known as commodity codes (CC). They’re required for import and export documentation, and they decide the tariffs and VAT (if any) that you’ll have to pay.

Therefore, it’s important to use the correct commodity code.

As of 1 January 2021, the UK will continue to use the same code system as is currently used in the EU.

Applying tariffs

Tariffs are a form of tax paid on imports, applied by the country to which the import is made.

In other words, tariffs in the UK are payable to HMRC. Also referred to as duty, tariffs are calculated at customs based on the commodity code.

As of 1 January 2021, the UK Global Tariff (UKGT) will replace the EU’s Common External Tariff. It will apply to all imports from countries for which the UK does not have a trade agreement.

If you export to an EU country, the customer may need to pay an import tariff. You should speak to your customers about this.

Customs declarations

While simplified declarations can be used until 30 June 2021 for goods from EU countries, following this, your business will need to ensure that a customs import declaration is made for goods that enter the UK from other countries including the EU (unless they’re going into temporary storage).

The declaration includes a number of pieces of information including the EORI, commodity code, customs procedure code (CPC), the value of goods, the weight or size and country of origin.

Import declarations can be complicated and require software that can integrate into the government’s Customs Handling of Import and Export Freight (CHIEF) system.

Due to the complexity, the government suggests businesses may want to use a freight forwarder, customs agent, or fast parcel operator to advise on, and complete import declarations.

Most goods imported to the UK can use the simplified frontier declaration system. This can mean goods pass through UK customs more quickly, and can reduce the amount of work upfront to import goods.

However, you’ll need to make a supplementary declaration later.

You need to be authorised to use the simplified declaration procedures, and you’ll need a duty deferment account (see below). You’ll also need to use the CHIEF system, as mentioned above.

Duty deferment account

If you import regularly then paying duties, VAT and excise duty monthly might make more sense, rather than paying them immediately upon import.

A duty deferment account lets you do this, although your bank or an insurance company will have to be willing to act as an approved guarantor on your behalf.

A duty deferment account is a necessity for the simplified frontier declaration system, as described above, and the six-month window in which you can make simplified declarations from 1 January 2021 to 30 June 2021.

Import licences

You may need to apply for licences to import certain goods into the UK, and some goods might require an inspection fee be paid.

Incoterms

Review the commercial terms of trade (Incoterms) in your contracts relating to importing goods. These will help you to understand who is responsible for customs duties, import VAT, and any additional transportation and insurance costs.

Additionally, Incoterms determine when risk and liability passes from the seller to the buyer – something that will not be as clear cut with customs borders, compared to the free travel of goods before Brexit/end of the withdrawal period.

Transport logistics

The organisations you use to transport goods across borders, such as sea shipping, couriers or air freight, will need to know many of the details above before shipping commences. You should consult with them to learn what they will require, and when.

Vat on Imports:

Import of Goods:

Import VAT

For goods imported from anywhere in the world, they have to account for import VAT. And as of 1 January 2021 this will include the countries within the EU.

The above applies only if the value exceeds £135. For imports beneath this amount, there’s still a need to account for VAT but you must use the new e-commerce rules (even if the goods were not traded via e-commerce). See the ‘VAT on imports £135 and under’ section below.

The VAT is applied at the point the goods are to enter free circulation, which is to say, this should be considered the VAT tax point.

The VAT can be paid at the tax point if you wish, in which case monthly C79 reports should be obtained from HMRC, as when importing from outside the EU.

But most businesses are likely to make use of the postponed VAT accounting system.

This is similar to the existing reverse charge mechanism, whereby import VAT is not physically paid upfront and then reclaimed on the subsequent VAT return. Instead, it’s accounted for as input and output VAT on the same VAT Return.

Although postponed VAT accounting is optional, it’s mandatory if you defer the submission of customs declarations.

It’s worth remembering that postponed VAT accounting can now be used for all imports outside of the EU too.

This represents a change from how VAT was accounted for prior to the end of the transition period, and is likely to provide a cash flow boost for businesses that import from outside the EU.

A new online monthly statement will be available as part of the postponed VAT accounting system. It’ll show the import VAT postponed for the previous month on a transactional basis and when you should include it in your VAT Return (that is, the correct tax point).

VAT on imports £135 and under

Alongside the end of the transition period on 1 January 2021, the UK is introducing additional measures for overseas goods arriving into Great Britain from outside the UK:

- Low Value Consignment Relief (LVCR) is being removed. Previously, this exempted imports with a value below £15 from import VAT.

- Online marketplaces (OMPs), where they are involved in facilitating the sale, will be responsible for collecting and accounting for the VAT.

- VAT on imports with a consignment value of £135 or lower will have VAT applied at the point of sale, rather than applied as import VAT at customs. For B2C transactions this UK VAT will be charged and collected by the seller but for B2B transactions the VAT will be revere charged to the customer.

Essentially, this means foreign sellers sending goods into the UK will need to charge UK VAT and apply to be part of the UK VAT system when supplying goods with a value of £135 or less to end consumers (that is, non-VAT-registered individuals).

Businesses who receive goods of £135 or less will have to account for the VAT as part of the reverse charge procedure, declaring the VAT on their next VAT Return. Normal rules apply for the tax point, which is to say, it will usually be the invoice date.

Additionally, the recipient business should ensure the seller knows their VAT number, or the seller will have no choice but to treat it as a B2C sale and apply VAT.

Import of services:

When it comes to VAT on services, as a general rule following Brexit/end of the transition period, sales of cross border purchases of services from one business to another (B2B) will remain subject to tax in the country of the customer (with some exceptions).

Therefore, the tax is generally accounted for as reverse charge in the destination country by the recipient of the service.

Changes to the VAT Flat Rate Scheme

Wednesday, May 3rd, 2017Changes to the VAT Flat Rate Scheme

As from 1st April 2017 a new flat rate percentage category has been created for businesses with limited expenditure. All businesses that fall within this category will be required to account for VAT using a 16.5% flat rate percentage against their gross turnover. The effect of this is that businesses will ultimately pay over almost all the VAT that has been charged to customers (19.8% of net).

According to HMRC a low cost trader is a business whose VAT inclusive expenditure on goods is:

- Less than 2% of their VAT inclusive turnover for the period; or

- Greater than 2% of turnover but less than £1,000 per annum

HMRC’s definition of ‘goods’ is an item purchased exclusively for business use and does not include:

- Capital expenditure

- Food & drink for the consumption of the business or its employees

- All costs associated with motor vehicles

- Services

If you currently use the VAT Flat Rate Scheme and are likely to now fall into the ‘Low Cost Trader’ category then you have a few options to consider:

- You could voluntarily de-register from VAT (if your VAT turnover is below the VAT de-registration limit)

- You could remain VAT registered but leave the Flat Rate scheme. Standard VAT accounting will allow you to recover input VAT on your expenditure however the increased administrative burden may need to be considered here.

- You could remain VAT registered and continue to use the VAT Flat Rate scheme applying the new percentage of 16.5% from 1st April 2017.

VAT flat rate scheme changes

Wednesday, March 15th, 2017Are you a ‘low cost’ trader?

If you currently use the VAT Flat Rate Scheme then the changes announced by The Chancellor in the Autumn Statement may effect you.

As from 1st April 2017 a new flat rate percentage category will be created for businesses with limited expenditure. All businesses that fall within this category will be required to account for VAT using a 16.5% flat rate percentage against their gross turnover. The effect of this is that businesses will ultimately pay over almost all the VAT that has been charged to customers (19.8% of net).

According to HMRC a low cost trader is a business whose VAT inclusive expenditure on goods is:

• Less than 2% of their VAT inclusive turnover for the period; or

• Greater than 2% of turnover but less than £1,000 per annum

Well what counts as goods I hear you ask, according to HMRC ‘goods’ must be exclusively used for business purposes and does not include:

• Capital expenditure

• Food & drink for the consumption of the business or its employees

• All costs associated with motor vehicles

• Services

If you currently use the VAT Flat Rate Scheme and are likely to now fall into the ‘Low Cost Trader’ category then you have a few options to consider:

1. You could voluntarily de-register from VAT (if you VAT turnover is below the VAT de-registration limit)

2. You remain VAT registered but leave the Flat Rate scheme. Standard VAT accounting will allow you to recover input VAT on your expenditure however the increased administrative burden may need to be considered here.

3. You remain VAT registered and continue to use the VAT Flat Rate scheme applying the new percentage of 16.5% from 1st April 2017.