Exporting from the UK to the EU Post Brexit.

March 19th, 2021Exporting from the UK to the EU Post Brexit. Here’s what you need to know, or setup, before exporting goods from the UK following our exit from the EU. EORI number You’ll need a UK EORI number beginning with GB or XI to export goods out of the UK. But you’ll also need to know […]

Continue ReadingImporting from the EU to the UK Post Brexit

March 19th, 2021Importing from the EU to the UK Post Brexit Here’s what you need to know, or setup, before importing goods from the EU after the end of the transition period (1 January 2021). Delaying customs import declarations for up to six months For most goods, there’ll be no need to make immediate import declarations for […]

Continue ReadingPRIVATE SECTOR OFF PAYROLL WORKING FOR INTERMEDIARIES (IR35)

February 20th, 2020PRIVATE SECTOR OFF PAYROLL WORKING FOR INTERMEDIARIES (IR35) From 6 April 2020, medium and large-sized private sector clients will be responsible for deciding whether intermediaries working for them are caught under the ‘off payroll working’ IR35 rules. This includes some charities and third sector organisations. (If a worker provides services to a small client in […]

Continue ReadingMaking Tax Digital

What is Making Tax Digital (MTD)? Making Tax Digital is a government initiative to make the UK tax system more digitally advanced by requiring businesses and landlords to keep their records in a digital format. The government states that over £9 billion is lost to the exchequer each year due to avoidable mistakes. They believe […]

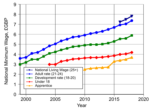

Continue ReadingNATIONAL MINIMUM WAGE AND MINIMUM PENSION CONTRIBUTIONS ARE CHANGING

NATIONAL MINIMUM WAGE / NATIONAL LIVING WAGE As of 1st April 2019 the National Minimum Wage and National Living Wage is to increase. The new rates are as follows: Age Group Hourly Rate 25 years old and over £8.21 21-24 years old £7.70 18-20 years old £6.15 16-17 years old £4.35 Apprentice £3.90 […]

Continue ReadingWORKPLACE PENSIONS CONTRIBUTIONS SET TO RISE

The minimum amount that employers and employees have to pay into their automatic enrolment pension scheme is increasing from 6th April 2018. The new contribution rates will apply from the payment period within which 6th April 2018 falls. Date Effective Employer Minimum Contribution Staff Contribution Total Minimum Contribution Current Rates […]

Continue ReadingTHE NATIONAL MINIMUM WAGE IS INCREASING

The National Minimum Wage is to increase from 1st April 2018. The National Minimum Wage is the minimum wage per hour a worker is entitled to in the UK. The new rates from the 1 April 2018 are shown below Age Group Hourly Rate 25 years old and over £7.83 21-24 years […]

Continue ReadingMicro-trader tax breaks get the chop

Over 600 pages of the 2017 Finance Bill have been hastily axed in order to pass the Bill prior to parliament being dissolved. Unfortunately, two of the casualties of this cull were the micro-trader and property allowances which were due to take effect from 6th April 2017. As things stand taxpayers are advised […]

Continue ReadingChanges to the VAT Flat Rate Scheme

Changes to the VAT Flat Rate Scheme As from 1st April 2017 a new flat rate percentage category has been created for businesses with limited expenditure. All businesses that fall within this category will be required to account for VAT using a 16.5% flat rate percentage against their gross turnover. The effect of this […]

Continue ReadingOff-payroll working in the public sector.

Off-payroll working in the public sector. The rules that apply to workers who provide their services to a public authority via their own limited company changed from 6th April 2017. Previously the obligation was on the worker to decide whether a contract performed was caught by the ‘intermediaries legislation’ (known as IR35) however since […]

Continue Reading