Author Archive

Budget October 2021

Thursday, October 28th, 2021On 27th October 2021 Chancellor Rishi Sunak delivered the Autumn 2021 budget. Whilst this budget was more focussed on spending, there are a few key points from this budget and previously announced tax rises.

The Health and Social Care Levy:

- A levy of 1.25% will be added to Class 1 (employers and employees) and Class 4 National Insurance contributions. This levy will apply from April 2022.

Personal tax rates on dividends:

- Tax rates payable on dividend income will increase by 1.25% from April 2022. The rates will therefore be 8.25% for basic rate taxpayers, 33.75% for higher rate taxpayers and 39.35% for additional rate taxpayers.

- The first £2,000 of dividend income is still tax free.

Business rates:

- Businesses in the retail, leisure and hospitality sector will receive a 50% reduction on business rates up to a £110,000 cap.

National living wage:

- From April 2022 the National Living wage rates will increase as follows:

- For people aged 23 or over – £9.50 per hour

- For people aged 21 or 22 – £9.18

- For people aged 18 – 20 – £6.83

- For people aged 16 or 17 and the apprenticeship rate – £4.81

Reporting of Capital Gains on residential property:

- The 30 day time limit for reporting and paying capital gains on the sale of residential property has been increased to 60 days.

- This was effective from 27 October 2021, meaning any sales that were completed on or after 27 October now have 60 days to report the gain and pay the capital gains tax.

Profit Vs Cashflow – What’s the difference?

Thursday, October 14th, 2021Cashflow and profit are very different. Business owners can often be confused into believing they are highly profitable because they have a large amount of cash and vice versa.

It is important to understand the difference between the two concepts.

What is cashflow?

The money that comes into, through and out of your business. It doesn’t include money owed to you from customers or credit from suppliers.

Insufficient cashflow means a business can’t meet its financial obligations such as paying suppliers or employees.

What is profit?

Profit is how much is left of your revenue once all costs have been deducted. It includes all income and costs that are due but not yet received or paid.

A business cannot survive in the long term if it is not profitable.

What is the difference?

The key difference between profit and cashflow is time.

Profit takes account of transactions as they are generated whereas cashflow takes account of transactions as they are paid or received.

As an example:

- A company sells goods for £1,000 on 31 March, but does not receive the money from the customer until 30 April

- Materials were purchased to produce these goods costing £250. The supplier was paid on 31 March for these materials.

- At 31 March:

- Profit:

- Sales – £1,000

- Materials – (£250)

- Gross profit – £750

- Tax @ 19% – £142.50

- Net profit after tax – £607.50

- Cashflow:

- Cost of materials – (£250)

- Net Cashflow – (£250)

- Cost of materials – (£250)

- Profit:

In the above example, at 31 March, the company has a positive profit but a negative cashflow.

The cashflow does not become positive until 30 April when the money is received from the customer.

Understanding this key difference can be crucial in keeping your business going.

A business can be highly profitable but if customers are on a 90 day payment term but suppliers are a 30 day payment term then you may not have the cashflow to keep the company going.

If you would like any assistance in understanding your profit and cashflow or would like a cashflow forecast preparing, please get in touch with us.

Corporate Expenses Guide – What business costs are tax allowable for Limited Companies

Wednesday, September 15th, 2021In general, tax-deductible expenses in a Limited Company must be wholly and exclusively for the use of the business.

If an expense has a dual purpose for both personal and business, you can only claim for the business element.

A summary of the rules for typical costs incurred by a company include:

- Staff expenses – As well as the salary and National Insurance contributions you pay to your employees the following costs are also allowable:

- Annual staff party – You can claim for the costs of hosting an annual staff party as long as the following conditions apply:

- The cost does not exceed £150 per head

- The main purpose of the event is to entertain your staff i.e., the majority of the guests should be employees

- The event must be open to all staff.

- It does not have to be a single function, it can be several functions over the year, but the total cost of all the events must not exceed £150 per head.

- Gifts and Trivial Benefits – You can buy small gifts for your employees, which will be fully allowable with no further tax and NIC implications provided the following conditions are met:

- It costs £50 or less to provide

- It isn’t cash or a cash voucher

- It is not a reward for their performance

- It is not included in the terms of their contract

- Eye tests and glasses – You can claim the cost of an eye test, only if you are required to use visual display equipment as part of your everyday job. You can also claim the cost of glasses only if the prescription is for screen-based work, not for a general prescription.

- Annual staff party – You can claim for the costs of hosting an annual staff party as long as the following conditions apply:

- Travel costs – You can claim for travel-related expenses for any business trips that you make. You cannot claim for the costs of your general commute (i.e. travel from home to your permanent place of work). Costs you can claim are as follows:

- Mileage – You can claim mileage for any business trips you make in your personal vehicle. HMRC approved mileage rates are as follows:

- Car or van – 45p per mile for first 10,000 and 25p over 10,000 miles

- Motorcycle – 24p per mile

- Bicycle – 20p per mile

- Transport fares – train tickets, flights, taxi fares etc.

- Parking charges and toll fees

- Accommodation for overnight trips – You can claim for the costs of accommodation for overnight business as long as the costs are reasonable and not excessive.

- Meals – You can claim for the costs of meals while working away in one of two ways:

- Actual costs incurred – you can claim for the costs of any food or drink purchased whilst on a business trip. You must keep evidence of the costs incurred.

- Using HMRC benchmark scale rates. These are approved rates set by HMRC that you can pay to cover the cost of subsistence while working away. You do not need to keep evidence of every cost incurred but there must be some evidence of checking that the employee did incur a cost. The rates are as follows:

- Minimum journey time – 5 hours – £5

- Minimum journey time – 10 hours – £10

- Minimum journey time – 15 hours (and ongoing at 8 pm) – £25

- General office costs – Postage, stationery, printing costs and other consumable office supplies are all allowable costs

- Use of home as office – You can claim for costs for using your home for business in one of two ways:

- Claiming a flat rate expense using HMRC approved rate of £6 per week

- Claiming a portion of your home expenses such as utilities. The calculation will be based on the number of rooms used for business and how long you use the rooms for

- Equipment – Purchases of equipment such as computers, printers and other office furniture like desks and chairs are subject to tax relief by way of claiming capital allowances.

- Protective clothing:

- The costs of protective equipment required for the business such as hi-visibility jackets, safety boots and safety helmets are an allowable expense.

- Uniform that is required to be worn by you and your employees is also an allowable expense

- The cost of normal clothing purchased for business, such as a new suit for a meeting, is not an allowable expense.

- Mobile phone:

- You can claim the full costs of a mobile phone bill as long as the contract is in the company name.

- If you pay for a mobile phone bill in your personal name, or your employees name, then only the business-related calls are allowable.

- If you pay for the full cost of a personal mobile phone bill, then this will be taxed as a benefit in kind.

- Landline and Broadband:

- If the landline and/or broadband is used solely for business, then the costs are fully allowable

- If landline and/or broadband is used for both business and personal, then you can only claim for the business portion. This will need to be broken down separately, for example using an itemised bill.

- Insurance – You can claim the cost of insurance as long as it is taken strictly for business purposes. Common types of business insurance include professional indemnity, public liability and employers’ liability insurance

- Relevant life cover – Relevant life cover is an allowable business expense. It must be a relevant life cover policy; standard life insurance policies are not a tax allowable expense.

- Professional fees – Payments for professional services such as accountants or solicitors’ fees are an allowable expense as long as the service is carried out solely for business purposes.

- Financial costs – bank & credit card charges and interest on loans and hire purchases are an allowable expense

- Marketing and Advertising – These costs are an allowable expense as long as they are incurred solely for business purposes

- Training – Training costs are an allowable expense as long as the content relates to your trading activity. Training courses to learn a new skill are not an allowable expense unless you can show that it will improve your business.

- Professional subscriptions – Subscription costs are an allowable expense as long as they are directly related to your trading activity.

- Mileage – You can claim mileage for any business trips you make in your personal vehicle. HMRC approved mileage rates are as follows:

If you are unsure if a cost is tax allowable or would like further advice on any of the above, then please get in touch with us.

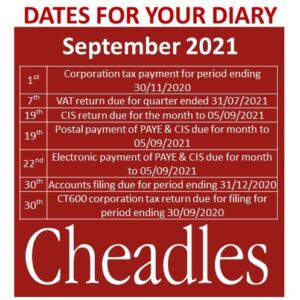

September 2021 Dates for your Diary

Monday, September 13th, 2021

An Employer’s Guide to Payrolling Statutory Payments

Thursday, August 5th, 2021

As an employer there are various statutory payments that you must pay your employees when they become eligible for them. Thinking about if your employee is eligible and what they need to be paid can seem like a daunting subject! This guide contains everything you need to know about making statutory payments.

Statutory Sick Pay (SSP)

For the 2021-22 tax year, Statutory Sick Pay should be paid at £96.35 per week and can be paid by an employer for up to 28 weeks of illness. After the 28 weeks, it is then at the discretion of the employer whether they continue to pay sick pay. Some companies offer a ‘Company sick scheme’, which may mean that the employee will be paid more than the SSP entitlement. If offered, this should be explained in the employment contract.

Is my employee eligible for SSP?

- The employee must have carried out some work for the employer.

- The employee must earn an average of £120 per week

- The employee must have been ill for more than 4 days in a row including non-working days. The first 3 days sick are not paid sick pay under SSP rules.

- The employer must be informed that you are not able to attend work within 7 days.

- For periods of sickness that are more than 7 days in a row, a ‘sick note’ from a doctor must be provided to the employer.

Linked periods of sickness

If you are ill for more than 4 days on multiple occasions that are less that 8 weeks apart, the sickness may be classed as being ‘linked’. This means that you do not have the 3 days unpaid ‘waiting period’ for every spell of sickness. If this is continuous for more than 3 years, you will no longer receive SSP.

As an employer, you cannot claim Statutory Sick Pay back from HMRC unless the sickness is Covid-19 related.

There are different rules regarding sick pay due to Coronavirus. If you would like further information on this, please call us on 01785 254550.

Statutory Maternity Pay (SMP)

Statutory Maternity Pay is paid to an employee for up to 39 weeks.

What should I pay my employee?

- First 6 weeks – 90% of the employee’s average gross weekly earnings

- Remaining 33 weeks – The lower of £151.97 or 90% of the average gross weekly earnings.

- Tax and National Insurance is to be deducted from SMP payments where applicable.

SMP starts when an employee begins their maternity leave, it also automatically begins if the employee is unable to work due to a pregnancy related illness within the 4 weeks before the baby is due.

Is my employee eligible for SMP?

- The employee must give the correct notice and proof of the pregnancy to be eligible for SMP.

- The employer must be notified of the pregnancy at least 15 weeks before the baby is due.

- The employer must then write to the employee within 28 days of being notified, confirming the start and end dates of the Maternity Leave.

- If the employer decides that the employee is not eligible for SMP, a SMP1 form must be provided within 7 days explaining the decision.

- The employee must earn on average £120 per week.

- The employee must have worked in the current employment for at least 26 weeks before the ‘qualifying week’. The qualifying week is the 15 weeks before the baby is due.

Can I claim back SMP from HRMC?

Employers can claim the SMP payments back from HMRC by reducing their monthly PAYE payments by the SMP amount.

Statutory Paternity Pay (SPP)

For the 2021-22 tax year, SPP is paid at the lower of £151.97 per week or 90% of the employee’s average gross weekly earnings.

Employees have a choice of taking SPP for 1 or 2 consecutive weeks leave and the start date must be either the day the baby is born or an agreed number of days following the birth.

Is my employee eligible for SPP?

- The employee must be one of the following:

- Father of the baby

- Child’s adopter

- Intended parent if they are having a baby through a surrogacy arrangement

- The employee must earn at least £120 per week in an 8-week relevant period and must have been employed for at least 26 weeks up to the qualifying week.

- The employee must give the correct notice of the pregnancy.

- The employee must be responsible for the child’s upbringing

Shared Parental Pay (ShPP)

Shared Parental Leave/Pay allows parents to split leave and pay following the birth of a baby.

Is my employee eligible for ShPP?

- Both parents must have been employed by their employer for at least 26 weeks before the qualifying week (15 weeks before the baby is due)

- Both parents must earn an average of £120 or more per week.

- The correct notice of the pregnancy must have been provided to the employer.

What should I pay my employee?

ShPP is paid at the lower of £151.97 per week or 90% of your average weekly earnings.

Statutory Adoption Pay

Statutory Adoption Leave is made up of 52 weeks split into 26 weeks Ordinary Adoption Leave and 26 weeks Additional Adoption Leave. Only one person in the couple can take adoption leave, however if this is the mother, then the father may also be entitled to Paternity Leave.

Adoption leave can start up to 14 days before the child starts living with you.

Is my employee eligible for SAP?

- The employee must give the correct notice of the adoption.

- The employee must provide proof of the adoption if the employer requires it.

- The employee must have been employed for at least 26 weeks before the week that they were matched with a child.

- Earnings must be an average of at least £120 per week

What should I pay my employee?

- First 6 weeks – 90% of the employee’s average gross weekly earnings

- Next 33 weeks – The lower of £151.97 or 90% of the average gross weekly earnings.

- The remaining 27 weeks would be unpaid or paid at the discretion of the employer

All the above payments must be recorded, processed and submitted to HMRC through a payroll scheme.

If you require any further information regarding any of the above statutory payments, please feel free to give us a call on 01785 254550.

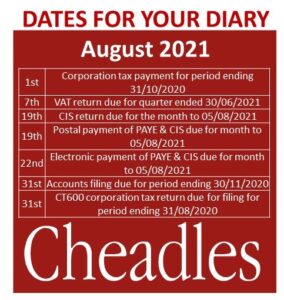

Dates for your diary August 2021

Monday, August 2nd, 2021

Should I put my car through my Limited Company?

Tuesday, July 13th, 2021Believe it or not, this is not as straightforward a question as it may seem. There are many factors to consider when deciding whether to put your car through your Limited Company.

Here is a summary of some of the key factors:

- If you use the vehicle privately, you will pay tax on the company car

- A company vehicle is classed as a benefit in kind and taxed both on the company and personally.

- The value of the benefit is a percentage of the list price of the vehicle. The percentage is based on the CO2 emissions. The higher the emissions, the higher the benefit.

- Your company will pay 13.8% National insurance on the benefit.

- The value of the benefit will be treated as additional income on you personally. You will be taxed on this based on the tax bracket that your income falls into.

- Is the cost of the vehicle tax deductible?

- This is dependent on whether you will be leasing the car or buying it.

- If you are leasing the car, then the monthly lease costs are an allowable tax expense, and so you will get tax relief on these costs. However, this will be limited to 85% of the cost if the car has CO2 emissions above 50g/km.

- If you are purchasing the car, then you get tax relief by claiming capital allowances. The rates of capital allowances on cars are as follows:

- Electric cars or CO2 emissions of 0g/km – 100% relief in the year of purchase

- CO2 emissions of 1-50 g/km – 18% relief per year

- CO2 emissions above 50g/km – 6% per year

- This is dependent on whether you will be leasing the car or buying it.

- Can you claim the VAT?

- Again, this is dependent on whether you are leasing or purchasing the car.

- If you are leasing, then you can claim all of the VAT back if the car is used 100% for business. If you use the car privately, then you can claim 50% of the VAT back on your monthly lease payments.

- If you purchase a car and use it 100% for business, you can claim the VAT back. However, if you use the car privately, you cannot claim any VAT back on the car’s purchase price.

- In both instances, to be classed as 100% business use, the vehicle must not be made available for private use, and you must be able to show that this is the case (i.e. in an employment contract). Travelling from home to your place of work would class as personal use.

- Again, this is dependent on whether you are leasing or purchasing the car.

- What about the running costs?

- Insurance, car tax and general repair costs are all tax allowable costs if your car goes through your Limited Company

- Fuel is also an allowable cost but is a taxable benefit in kind and will be taxed in a similar way to the cost of the car (as mentioned in point 1) unless only fuel for business use is claimed.

- What can you claim if you don’t put your car through the company?

- You can claim business mileage for any business miles you do in your personal vehicle.

- The rates for business miles are 45p per mile for the first 10,000 miles and 25p per mile after that.

- Insurance, tax, repairs and fuel are all covered by the mileage rate, so you cannot claim these costs on top of the mileage.

- What about vans?

- If you buy a commercial vehicle, such as a van, then different rules apply.

- You can claim the full cost of the van (or monthly leasing payments) in the year of purchase by claiming AIA.

- You can claim the VAT back

- If you use the van personally, you will be charged a benefit in kind, but this is a set amount each year and is not based on the vehicle’s list price. For 2021/22 this amount is £3,500.

As you can see, there are many things to consider when deciding whether to put your vehicle through your Limited Company.

As a general guide, then it is not usually beneficial to put a vehicle through the company unless it is a commercial vehicle or has very low CO2 emissions, but each case is different.

Please get in touch with your client manager if you are considering purchasing a new vehicle, and they can advise you on whether you should purchase through your Limited Company or not.

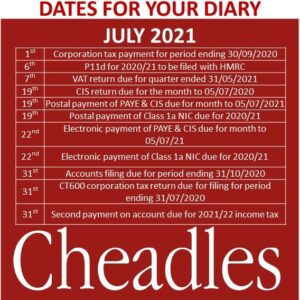

July 2021 Dates for your Diary

Thursday, June 24th, 2021

Payrolling Benefits; An employer’s guide to payrolling employee benefits

Tuesday, June 22nd, 2021Payrolling Benefits; An employer’s guide to payrolling employee benefits

In 2016 HMRC introduced the option for employers to payroll employee benefits in kind. This allows employers to process employee’s benefits through payroll and pay tax on the deduction throughout the year rather than submitting and paying it via a P11D at the end of the tax year.

A benefit is an additional payment given to an employee by their employer that is not part of their usual salary. This may include things such as payments for a company car or medical benefits.

Employers may wish to offer these benefits as a reward to employees for years of service or simply to make a role more attractive to prospective employees.

Advantages of Payrolling Benefits

- P11D forms will no longer need to be filled out for each employee. This reduces end of year administration for the employer. (Class 1a NIC still needs to be calculated and reported via a P11D(b) form)

- Employees are more likely to pay the correct tax that is due on their benefits throughout the year. By payrolling benefits monthly, it is more likely that PAYE tax codes will be updated timely and efficiently by HMRC, leading to less chance of underpaid liabilities at the year-end.

- Employees tax payments are spread out across the year rather than one big lump sum tax payment being made at the end of the tax year.

- Your employees can see all benefits listed on their payslips.

Disadvantages of Payrolling Benefits

- The benefit value and tax must be calculated correctly and accurately during the tax year.

- Any changes to the benefit value during the year must be tracked, and the taxable values must be amended accordingly in the relevant pay period to avoid HMRC Penalties.

- You have to wait until the end of a tax year if you wish to cease payrolling a benefit (unless an employee leaves your employment).

Which benefits are taxable?

There are many employee benefits that can be payrolled; some of these will be subject to tax and national insurance deductions.

Here are some examples of taxable benefits:

- Company cars that are also used for private use

- Fuel that is subject to private use

- Medical and dental insurance

- Mobile Phones

- Gym memberships

Here are some examples of non-taxable benefits:

- Living accommodation

- Training

- Low interest/Interest-free loans

Non-taxable benefits still need to be declared to HMRC via a P11D.

Here is a link to the HMRC website that lists all benefits and will give you further information as to whether they are taxable. https://www.gov.uk/expenses-and-benefits-a-to-z

The 50% rule

Benefits cannot be paid to an employee if the tax on this benefit constitutes to more than 50% of their salary. For example, if an employee were paid maternity pay and this meant their salary was less than usual, payrolling of the benefit would need to stop during that time and instead, reported on a P11D at the year-end. This would then allow HMRC to incorporate the tax due in the employee’s following year tax code.

DEADLINES

If you would like to start payrolling benefits, you must register with HMRC before 5th April of the year in which the benefit will relate to. You can do this by filling in an online form through your HMRC government gateway account.

Employees must be notified of the benefits and what it means for them before the benefit is processed via the payroll.

Class 1A NIC must be calculated and reported via a P11D(b) form to HMRC by 6th July of the following year that in which the benefits relate to.

The Class 1A NIC due per the P11D(b) form must be paid to HMRC by 19th July (22nd July if paying electronically) following the tax year in which the benefits relate to.

For example, any benefits that were payrolled in the 2020/2021 tax year must be submitted via a P11D(b) by 6th July 2021 and paid by 19th July 2021.

If you need any advice or further information regarding employee benefits, please give us a call on 01785 254550.

A Guide to P11D’s

Friday, June 11th, 2021A guide to employee benefits that must be reported on a P11D:

The P11D is used to tell HMRC about the cash value of any expenses and benefits that don’t go through payroll.

Anything the company pays for or buys for the direct benefit of an employee should be included.

The most common benefits that are reportable on a P11D include:

- Company cars and vans where there is an element of private use.

- Medical or dental treatment and other forms of insurance.

- Mobile phones and internet where there is private use (unless the contract is in the company name)

- Low interest or interest-free loans in excess of £10,000.

- Gym memberships.

- Accommodation provided to employees.

- Assets sold or given away to employees.

You don’t have to report certain business expenses and benefits like business travel & entertaining, phone bills, uniform & tools for work as long as you are re-imbursing in one of the following ways:

- paying a flat rate to your employee as part of their earnings – this must be either a benchmark rate or a special (‘bespoke’) rate approved by HMRC

- paying back the employee’s actual costs

The deadline to submit a P11D for 2020/21 is 6th July 2021.

If you need any advice on employee benefits or think you may have to submit a P11d, please get in touch.