Archive for the ‘Uncategorized’ Category

An Employer’s Guide to Payrolling Statutory Payments

Thursday, August 5th, 2021

As an employer there are various statutory payments that you must pay your employees when they become eligible for them. Thinking about if your employee is eligible and what they need to be paid can seem like a daunting subject! This guide contains everything you need to know about making statutory payments.

Statutory Sick Pay (SSP)

For the 2021-22 tax year, Statutory Sick Pay should be paid at £96.35 per week and can be paid by an employer for up to 28 weeks of illness. After the 28 weeks, it is then at the discretion of the employer whether they continue to pay sick pay. Some companies offer a ‘Company sick scheme’, which may mean that the employee will be paid more than the SSP entitlement. If offered, this should be explained in the employment contract.

Is my employee eligible for SSP?

- The employee must have carried out some work for the employer.

- The employee must earn an average of £120 per week

- The employee must have been ill for more than 4 days in a row including non-working days. The first 3 days sick are not paid sick pay under SSP rules.

- The employer must be informed that you are not able to attend work within 7 days.

- For periods of sickness that are more than 7 days in a row, a ‘sick note’ from a doctor must be provided to the employer.

Linked periods of sickness

If you are ill for more than 4 days on multiple occasions that are less that 8 weeks apart, the sickness may be classed as being ‘linked’. This means that you do not have the 3 days unpaid ‘waiting period’ for every spell of sickness. If this is continuous for more than 3 years, you will no longer receive SSP.

As an employer, you cannot claim Statutory Sick Pay back from HMRC unless the sickness is Covid-19 related.

There are different rules regarding sick pay due to Coronavirus. If you would like further information on this, please call us on 01785 254550.

Statutory Maternity Pay (SMP)

Statutory Maternity Pay is paid to an employee for up to 39 weeks.

What should I pay my employee?

- First 6 weeks – 90% of the employee’s average gross weekly earnings

- Remaining 33 weeks – The lower of £151.97 or 90% of the average gross weekly earnings.

- Tax and National Insurance is to be deducted from SMP payments where applicable.

SMP starts when an employee begins their maternity leave, it also automatically begins if the employee is unable to work due to a pregnancy related illness within the 4 weeks before the baby is due.

Is my employee eligible for SMP?

- The employee must give the correct notice and proof of the pregnancy to be eligible for SMP.

- The employer must be notified of the pregnancy at least 15 weeks before the baby is due.

- The employer must then write to the employee within 28 days of being notified, confirming the start and end dates of the Maternity Leave.

- If the employer decides that the employee is not eligible for SMP, a SMP1 form must be provided within 7 days explaining the decision.

- The employee must earn on average £120 per week.

- The employee must have worked in the current employment for at least 26 weeks before the ‘qualifying week’. The qualifying week is the 15 weeks before the baby is due.

Can I claim back SMP from HRMC?

Employers can claim the SMP payments back from HMRC by reducing their monthly PAYE payments by the SMP amount.

Statutory Paternity Pay (SPP)

For the 2021-22 tax year, SPP is paid at the lower of £151.97 per week or 90% of the employee’s average gross weekly earnings.

Employees have a choice of taking SPP for 1 or 2 consecutive weeks leave and the start date must be either the day the baby is born or an agreed number of days following the birth.

Is my employee eligible for SPP?

- The employee must be one of the following:

- Father of the baby

- Child’s adopter

- Intended parent if they are having a baby through a surrogacy arrangement

- The employee must earn at least £120 per week in an 8-week relevant period and must have been employed for at least 26 weeks up to the qualifying week.

- The employee must give the correct notice of the pregnancy.

- The employee must be responsible for the child’s upbringing

Shared Parental Pay (ShPP)

Shared Parental Leave/Pay allows parents to split leave and pay following the birth of a baby.

Is my employee eligible for ShPP?

- Both parents must have been employed by their employer for at least 26 weeks before the qualifying week (15 weeks before the baby is due)

- Both parents must earn an average of £120 or more per week.

- The correct notice of the pregnancy must have been provided to the employer.

What should I pay my employee?

ShPP is paid at the lower of £151.97 per week or 90% of your average weekly earnings.

Statutory Adoption Pay

Statutory Adoption Leave is made up of 52 weeks split into 26 weeks Ordinary Adoption Leave and 26 weeks Additional Adoption Leave. Only one person in the couple can take adoption leave, however if this is the mother, then the father may also be entitled to Paternity Leave.

Adoption leave can start up to 14 days before the child starts living with you.

Is my employee eligible for SAP?

- The employee must give the correct notice of the adoption.

- The employee must provide proof of the adoption if the employer requires it.

- The employee must have been employed for at least 26 weeks before the week that they were matched with a child.

- Earnings must be an average of at least £120 per week

What should I pay my employee?

- First 6 weeks – 90% of the employee’s average gross weekly earnings

- Next 33 weeks – The lower of £151.97 or 90% of the average gross weekly earnings.

- The remaining 27 weeks would be unpaid or paid at the discretion of the employer

All the above payments must be recorded, processed and submitted to HMRC through a payroll scheme.

If you require any further information regarding any of the above statutory payments, please feel free to give us a call on 01785 254550.

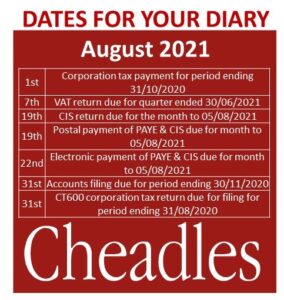

Dates for your diary August 2021

Monday, August 2nd, 2021

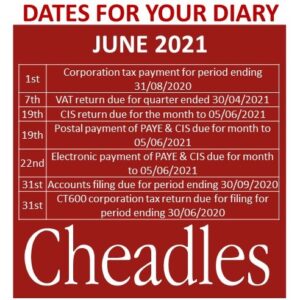

Dates for your Diary June 2021

Wednesday, May 26th, 2021

Why Cloud Accounting?

Wednesday, May 12th, 2021Why Cloud Accounting?

9 Reasons Why Cloud Accounting is the FUTURE of accounting!

- Automatic Bank Feeds

Cloud accounting software has a feature that allows bank transactions to be downloaded into your software daily, therefore there is no longer a need to spend hours typing out your statement line by line.

- You can view your companies’ financial position anywhere at any time!

Gone are the days of sitting at your computer to view your company financials; most cloud accounting software such as Xero, QuickBooks and FreeAgent have apps that can be downloaded straight onto your smartphone. You can even take pictures of your receipts and upload them directly to the app whilst you are on the go!

- Cloud accounting software allows multi-user access.

Multi-user access means both you and your accountant can keep up to date with your company financials. Giving your accountant access to this information puts them in the best position to advise you on your financial position throughout your accounting year.

- Cloud accounting software is SPACE SAVING software!

Cloud accounting software such as Xero allows you to store everything in one place. Invoices can be emailed straight into your Xero inbox. You can also attach pictures of your receipts to the relevant expense in the software – not only will you save on printing costs, but you will no longer need endless shelves to store all your invoices, simply snap and upload a picture of your receipts to your software and there is no need to keep the paper copies.

- You will always be logged into the most up to date version of your software.

Cloud accounting software does not need you to download updates each time there are new tax rates announced. Your software will change in line with new government finance guidelines for you.

- Allows for a ‘WORK SMARTER, NOT HARDER’ mindset

Running a business requires a lot of organisation and record-keeping, however, cloud accounting software can do a lot of the tedious bookkeeping work for you. From automatic bank feeds to sending automated reminders to customers that owe you money, there is a whole range of mundane tasks that your software will now complete for you giving you more time to focus on building your business.

- The Cost-Effective Option

In many cases, the ‘cloud’ version of the software is cheaper than their desktop counterparts. This means you’re staying on top of the latest software whilst also saving cash!

- Software that is secure and safe!

As suggested by their name, online software such as Xero, Quickbooks and FreeAgent are all stored ‘in the cloud’. Unlike their desktop friends, they do not need to have regular data backups taken and the data you enter will never be lost!

Each Cloud software allows you the option to set up 2-factor authentication to gain access to the login. This means your business data will be kept safe and can only be accessed by those you allow.

- Data Capturing Software

Software’s such as HubDoc and Receiptbank can be used alongside your software. They use OCR technology to extract the key information from your invoices and feed them into your bookkeeping software. This can save you lots of time as you do not have to manually enter each of your invoices onto your software.

If you need any help or advice on choosing the right cloud accounting software for you please give us a call on 01785 254550.

May 2021 Dates for your Diary

Friday, April 23rd, 2021

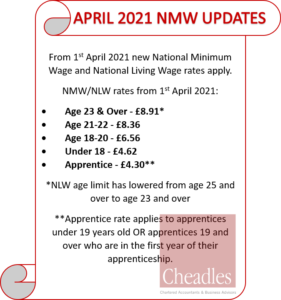

April 2021 National Minimum Wage rates

Thursday, April 1st, 2021

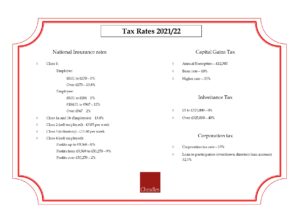

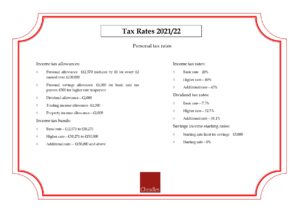

Tax Rates 2021/22

Wednesday, March 31st, 2021

Tax Rates 2021/22

Wednesday, March 31st, 2021

What Is Domestic Reverse Charge

Wednesday, March 31st, 2021What is the domestic reverse charge:

A change in the way CIS registered construction workers handle and pay VAT.

When does it apply:

Domestic reverse charge became effective on 1 March 2021.

Who does it affect:

Individuals or businesses within the CIS scheme who are VAT registered. It applies to standard and reduced rate supplies.

What does it mean for you:

- If you are a subcontractor:

- You will no longer charge VAT to your CIS customers if they are not the end-user of your service (the end-user is the final customer who will not make an onward supply of the building and construction services supplied to them).

- You will need to state on your invoices that the customer is responsible for VAT and show the VAT rate that would apply to your sale.

- The value of the sale will be included in your net sales figure on your VAT return, but no output VAT will be included.

- If your customer is the end-user or your supply is zero-rated, then you will account for VAT in the normal way and the domestic reverse charge will not apply.

- If you are a contractor:

- You will report the VAT from your subcontractors’ invoice as both output VAT and input VAT.

- The net value of the invoice will be reported in your net purchases amount but NOT in your net sales amount.

Impact on your business:

- Cash flow:

- If you are a subcontractor then this change will have a negative impact on your short-term cash flow as you will now be receiving the net amount of your sales invoice rather than the gross. Many businesses rely on the time delay between receiving the VAT element of their sales invoice and paying it over to HMRC. Businesses should, therefore, consider how they will deal with this change.

- If you are a contractor then this change will have a positive impact on your short-term cash flow as you will only be paying the net amount to your subcontractors rather than the gross.

- Accounting systems:

- If you are a contractor then the way you report your purchases from your subcontractors has changed. You will need to ensure that your accounting systems are sufficient to help you deal with this change. Most cloud accounting software is equipped to deal with the domestic reverse charge, so if you are not using cloud software yet then now may be a good time to start.

- Flat rate VAT scheme:

- You cannot account for reverse charge supplies using the flat rate scheme. Reverse charge supplies must be dealt with as outlined above.

- If you are on the flat rate scheme and the domestic reverse charge applies to you then you will need to consider if it is still beneficial for you to remain on the scheme.

- VAT refunds:

- If you are a subcontractor and all, or majority, of your sales, are dealt with through the reverse charge scheme then it is likely that your VAT returns will now result in refunds being payable to you as you will claim the VAT on all your relevant purchases but will have no, or little, VAT to pay over on your sales.

If you need any help or advice on the Domestic Reverse Charge, please do not hesitate to contact us and we will provide all the assistance you need.

Exporting from the UK to the EU Post Brexit.

Friday, March 19th, 2021Exporting from the UK to the EU Post Brexit.

Here’s what you need to know, or setup, before exporting goods from the UK following our exit from the EU.

EORI number

You’ll need a UK EORI number beginning with GB or XI to export goods out of the UK. But you’ll also need to know the EU EORI number for the European business you’re exporting to.

Commodity codes

The importer in the EU will need to pay tax and duty on what you export to them. Therefore, it’s important to ensure you use the correct commodity codes.

Export declarations

As with importing, the government suggests you hire a freight forwarder, customs broker or fast parcel operator for making customs declarations. If making declarations yourself, you’ll need to register for and use the National Export System (NES), which will let you make declarations electronically. You’ll need what’s known as a CHIEF badge role.

Export licences

Some goods require export licences, and there are additional rules specific to alcohol, tobacco and certain oils, and for controlled goods. You’ll need to ensure you have these in place prior to export.

Incoterms

Businesses should review the commercial terms of trade (Incoterms) in contracts relating to delivery of goods for those you export to. These will help you to understand who is responsible for customs duties, import VAT and any additional insurance and transportation costs.

Transporting goods

Businesses can utilise commercial goods transportation services, which is certainly the easiest option, or opt to use their own transport.

Trade tariffs

Your customers in the EU may now have to pay tariffs when they import from you, when previously they didn’t need to do so. This will need to be part of your pricing calculations, and you might find it impacts demand.

You should discuss this issue with your clients so that it doesn’t come as a shock to them or cause their goods to be held in local customs.

VAT on exports:

VAT on export of goods:

As of 1 January 2021, when it comes to exporting goods to EU countries, the VAT situation also changes. Exports to EU countries are treated like those to non-EU countries, which is to say, they should be zero-rated for UK VAT.

This will apply regardless of whether you’re exporting goods to a consumer (B2C), or to a business (B2B).

This could mean businesses selling B2C to the EU need to register for EU VAT and appoint fiscal representatives depending on the requirements of the countries in which they sell.

VAT on sale of services:

When it comes to purchasing services, rather than goods cross-border, things continue much as they did before 1 January 2021.

Under the place of supply rules:

- B2B sales of services will continue to be generally subject to tax in the country of the customer and administered through reverse charge, with some exceptions. – No VAT charged but included in Box 6.

- B2C sales of services will continue to be generally subject to tax in the country of the seller, again with some exceptions. – VAT charged in normal way

VAT on sale of digital services:

All sales of digital services are subject to tax in the country of the customer.

UK businesses that use the Mini One-Stop Shop (MOSS) system will need to register for the non-union MOSS and will no longer benefit from a €10k threshold before having to apply the place of supply rules.

This means many more businesses may be liable to VAT in the countries they sell digital services to and will need to register for non-union MOSS.

VAT will need to be charged at the rate applicable in the country of the customer.